The put up Visa presents its 2025 Cash Travels remittances report for the Asia-Pacific appeared first on TD (Journey Every day Media) Journey Every day Media.

World digital funds platform Visa introduced the outcomes of its annual Cash Travels: 2025 Digital Remittances Adoption Report on Wednesday, thirteenth August.

The report relies on responses from 44,000 senders and receivers throughout 20 nations and territories, monitoring remittance tendencies all over the world, together with Asia Pacific, a key area within the $905 billion world remittance panorama.

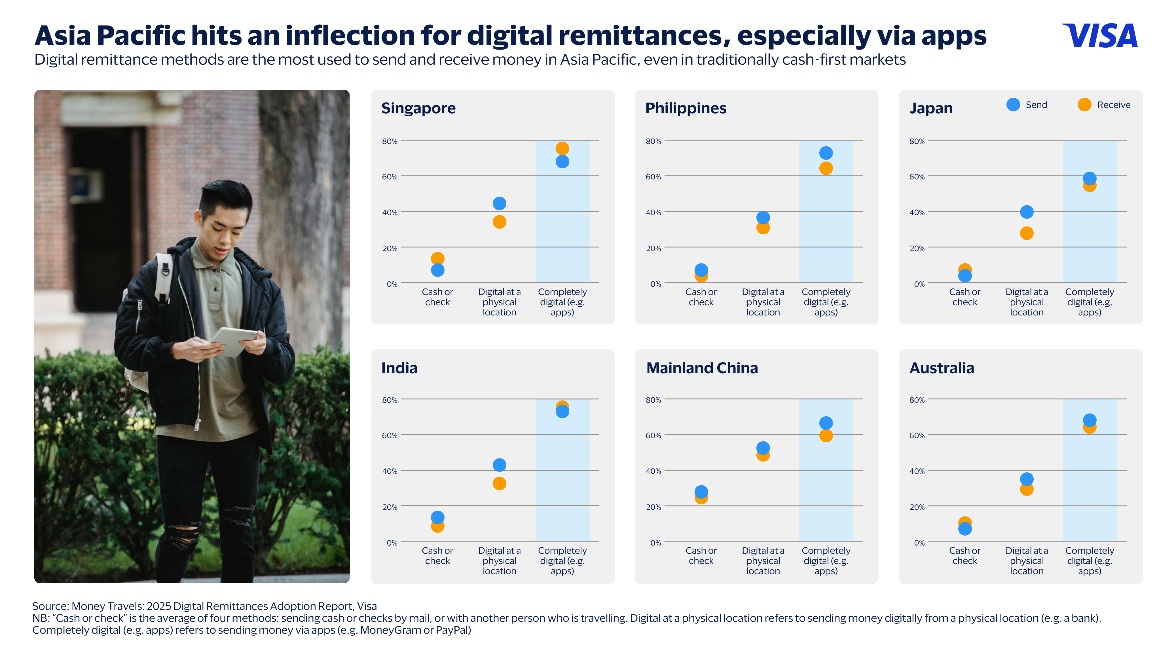

Key findings on this 12 months’s survey present digital purposes as the most well-liked methodology for sending and receiving remittances, and ease of use, security, privateness, and safety as the highest 4 consumer expertise advantages driving such desire.

In keeping with Visa’s senior vice-president and head of economic and cash motion options within the Asia-Pacific Chavi Jafa: “Remittances have lengthy pushed development throughout Asia Pacific, uplifting many economies within the area. The clear shift to app-based remittances displays the area’s demographics, the rising prominence of digital cost modes, in addition to consumer preferences for straightforward, protected and fast methods to ship and obtain cash. This shift is a vital one for banks, remitters and fintechs to notice as it can form how they have interaction and serve evolving shopper expectations.”

Key findings for the Asia-Pacific

Digital apps stay the most well-liked and are perceived because the quickest choice

- Digital apps are probably the most most well-liked channel to ship/obtain remittances in Asia Pacific, with utilization charges reaching its highest in India (74%/76%), the Philippines (74%/66%), and Singapore (70%/75%).

- Japan can also be seeing regular development, with digital app utilization rising by 10% (58%/56%) in 2025 in comparison with the earlier 12 months.

- Over half of the respondents within the Philippines (73%/73%), Australia (58%/55%), Singapore (67%/66%), and India (55%/53%) understand digital funds because the quickest method to entry funds (73%).

- Most Asia Pacific remittance customers surveyed report experiencing no points with sending/receiving digital remittance transfers throughout all Asian markets, most positively in Australia (48%/53%), Japan (37%/41%), Singapore (36%/37%), and Mainland China (38%/31%, rising considerably since 2024 at +13%/+8%).

Remittance rationale varies throughout the area

- Contributing to accounts/investments is a major purpose to ship/obtain remittances throughout a number of markets together with Mainland China (45%/36%), Singapore (38%/33%), and Japan (27%/23%).

- Sending for common/particular humanitarian want is a key purpose for remittances, cited by respondents in Mainland China (45%/33%), India (40%), Singapore (27%), and Australia (25%).

- Sending remittances for an sudden want was highest in India (44%), the Philippines (41%), and Australia (31%).

- Receiving common remittances was cited by roughly a 3rd of respondents within the Philippines (39%), Mainland China (34%), and India (30%).

Safety and comfort outweigh ache factors reminiscent of charges

- Digital apps are seen as probably the most safe method to ship/obtain remittances in Asia Pacific, with high responses from India (50%/53%), Australia (49%/45%), and Singapore (44%/42%).

- Ease of use to ship/obtain digital remittances was famous most by respondents in Singapore (51%/51%) the Philippines (48%/54%), Japan (47%/42%), and Australia (42%/40%).

- Digital app charges for sending/receiving remittances had been highlighted as a high ache level throughout Asia Pacific, led by the Philippines (43%/30%), India (36%/33%), and Singapore (32%/32%).

- Equally, excessive charges had been famous as the highest ache level for sending bodily remittances throughout all markets, with high responses from the Philippines (45%/29%), India (41%/37%), Singapore (38%/30%), Australia (29%/30%).

- Inconvenience and lengthy journey distances stay key challenges for sending bodily remittances, with respondents in India (36%) and Mainland China (27%) citing journey as a barrier. In Australia and Singapore, 29% of respondents every famous the bodily remittance course of as inconvenient and time-consuming alongside issues about excessive charges.

- Throughout most Asia Pacific nations surveyed, the perceived safety of bodily remittances was low (3%-6%), with Mainland China reporting barely greater ranges of confidence (10%-12%).

A have to continually innovate

With one billion folks relying yearly on remittance providers and platforms, Visa continues to innovate and construct options to allow funds companies to boost operational effectivity in cash motion and broaden monetary entry for his or her prospects.

Rhidoi Krishnakumar, vice-president and head of Visa Direct within the Asia-Pacific, mentioned: “Remittances have lengthy been a lifeline throughout Asia Pacific, and they’ll proceed to play an important function in uplifting communities and livelihoods. On the identical time, many small companies are additionally beneficiaries of remittances driving native development in native economies.”

Visa recognises the enduring function of our function in delivering remittances on behalf of its purchasers and continues to innovate and construct options to allow extra environment friendly, dependable and safe methods to maneuver cash.

With that in thoughts, Visa works in collaboration with world remitters, reminiscent of MOIN, WireBarley, Cash Chain World Remittance and EzRemit, to assist allow environment friendly cash motion via digitised remittances.

The put up Visa presents its 2025 Cash Travels remittances report for the Asia-Pacific appeared first on Journey Every day Media.

Leave a Reply